|

An Access Database is available.

There was a very thought-provoking article by Martin Wolf in the

Financial Times newspaper for March 11th. 2016 entitled

"Good news � fintech could disrupt finance�.

It states �Banking is currently inefficient, costly and riddled with conflicts of interest�.

It identifies three possible sources of disruption :

1.Payments Transformation, with one possibility being real-time settlements via

distributed ledgers.

2.Peer-to-peer Lending, in which new platforms disintermediate the traditional

businesses in matching savers with investments.

3.Big Data � �this might transform the quality of lending, which would be a good

thing. But the most striking effects are likely to be felt in insurance. With new

monitoring devices, insurers might gain direct knowledge of the quality of driving or

of the state of the clients� health�.

Our new Banking Data Platform reflects this article.

The Specifications for this Platform have been derived from an excellent and very thought-provoking article by Martin Wolf

in the Financial Times newspaper for March 11th. 2016 entitled "Good news � fintech could disrupt finance�.

It states �Banking is currently inefficient, costly and riddled with conflicts of interest�.

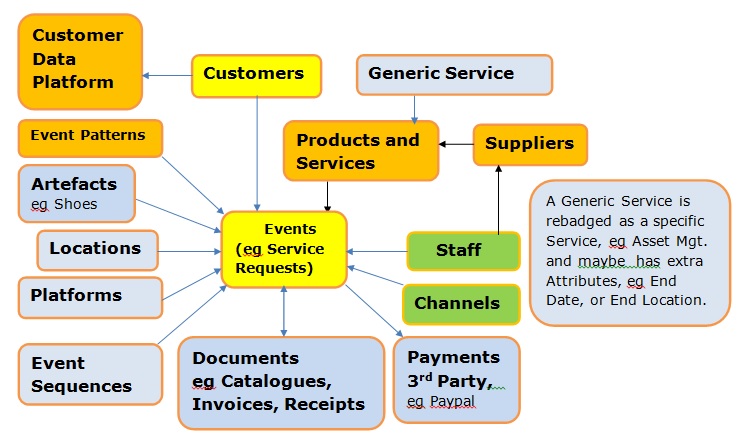

The Conceptual Banking Platform Data Model

|

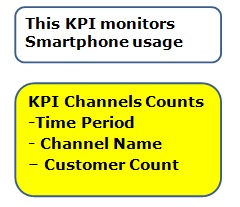

Conceptual KPI Channel Count.

|

Logical KPI Channel Count.

|

Basic Conceptual Dimension Model showing 5 Dimensions of Channel, Customer, Date, Geography and Product

|

Logical Dimension Model showing the same 5 Dimensions of Channel, Customer, Date, Geography and Product

|

The Conceptual Banking Data Warehouse Model

|

The Logical Banking Data Warehouse Model

|

Conceptual version of Our Canonical Data Model

|

Our Participants ERwin Canonical Data Model

This is a little different from the Conceptual version

|

May 21st. 2017

Database Answers Ltd.

London, England

|

© Database Answers Ltd. 2017

|