|

Back to the Data Model

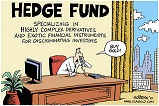

Draft Specifications for a Hedge Fund Platform.

Hello Barry.

I have stumbled across your website and am completely fascinated with what you have made available here!!

This is a wealth of knowledge, thanks for making it accessible.

We are planning a project for a small hedge fund developing an API platform for them to place orders, monitor various market activities, etc.

We are still defining exactly what this project is going to be and one of the things they want me to consider is a means for recording transactions,

updating balances when positions are opened and/or closed, generating reports both to clients of their accounts and also for management

(reports of their trader's performance).

This will most likely consist of a SQL Server backend and an Access front end.

I am somewhat familiar with the database world. Based on the chart on your website, I'm somewhere between basic and intermediate.

Anyhow, my question is this: in looking at your sample architectures, I've noticed the different models for Data Marts, BI, etc.

Exactly what form do these actually take?

Do you suggest creating separate databases (a Data Mart db, a separate BI db) which all share linked tables but have their own relationship structures

or is each component of the architecture a saved query of some kind inside of a single database?

Or perhaps something different that I haven't thought of...

Would you please send me the db for tracking share transactions?

Anyway, thank you for the site, books and all the info!!

Brennan

© Database Answers Ltd. 2017

|

|